Welcome to Sweden and welcome to Gothenburg! Did you bring enough money? Credit card?

No, this isn’t about me. I’ll be happy to take (some of) your money in exchange for an unforgettable tour experience though. This is about a news cast I heard this morning and some things I’ve experienced with guests of mine: money, credit cards and tips. Let’s take the easy one first: tips.

Tips, unlike the US, are included in Sweden

Most European countries include tips in their charge, e.g. in restaurants, cabs, etc. So you don’t have to whip out your calculator and crunch numbers. Here in Sweden, it’s customary to only tip when you’re particularly pleased with your server’s work, and we do that by rounding up to the nearest round figure.

E.g. if your restaurant bill is SEK 947:-, we’d round up to SEK 960 or 970, depending on how generous we feel. But you’re not obliged to do so and nobody will frown if you don’t. Servers here are paid a union salary and tips are added automatically. However, if you want to tip in cash, that is fine. I’ve yet to find a server who complains about a tip.

Please note: new Credit Card readers

Some of the new cordless credit card readers (or terminals) that the server or taxi driver will hand to you will include the option to add the tip on your card (so no hassle with cash.)

You’ll first have to enter the total amount (after the server entered the amount on the bill) before you proceed to enter your pin code or ask for a copy to sign. Be sure not to enter your pin as a total. There is a protection in case the amount you enter differs too much from the bill but it’s embarrassing to have your waiter see your pin as a total amount. #BeenThere

Other service providers are tipped using the same approach. They’re all on a salary and don’t need the tips to make their living! However, if someone does an exceptional job, they’ll gladly accept your tip.

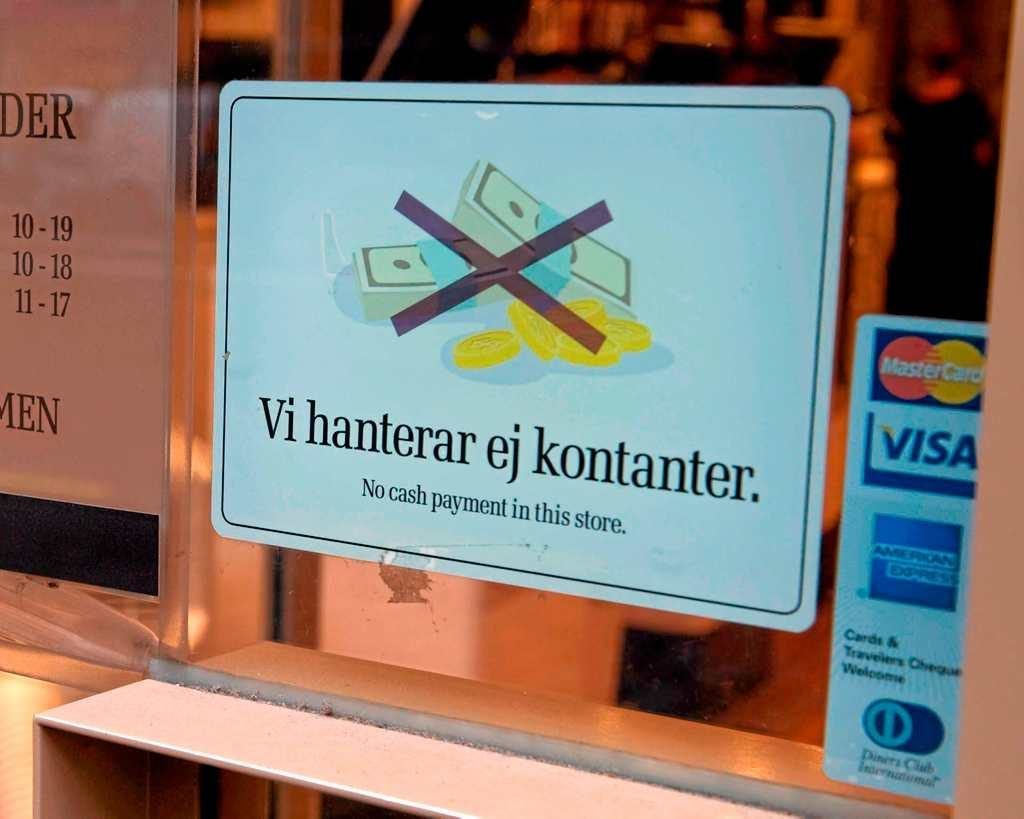

Sweden is well in its way to be the first cash-free society

Regardless of whether you lament or applaud this development, fact is that about 90% of all payments in our country are handled either by Credit Card or Swish (similar to Venmo in the US.) Swish, in particular, has become an indispensable service for payments between people. Fast and free of charge (for now.) There are more and more stores, hotels and restaurants who no longer accept cash.

For visitors from countries where cash is still king, this can be a bit distressful. You’re hungry, order a meal but can’t pay for it. Trust me, we had the equivalent moment a few months ago in Hamburg, just the opposite way, having to leave three restaurants in a row because they did NOT accept credit cards.

Prepare for your trip to Sweden

The good news is that you won’t need to run to your foreign exchange bureau and worry about what size bill you’ll most likely need or what to do with leftover coins nobody will take back.

But, you need to bring your credit card, and you’ll always have to carry an official picture ID with you (passport, driver’s license, national ID card.) You should also, if your bank offers it, get a card that offers an NFC chipped card.

The European Union has new laws coming into effect this month (on the 14th) which will require all EU citizens to be able to use their PIN-code to pay for their goods in stores. Signatures will no longer be accepted. Keep that in mind. If you travel from outside the EU/EES area, nothing changes, but you’ll need your ID to prove who you are (if you do not have a PIN-code.)

The new legislation also affects credit card payments online, at least for us living in the EU/EES. If you need more info, ask your bank or google “RTS/SCA” to learn more.

“Blipping”

What’s better? To pay in SEK or my home currency?

I’ve seen this myself abroad: the store or restaurant where I pay offers me to either pay in local currency or in my home currency. Based on my experience, I’ve always fared better to use local currency and let my bank handle the exchange. Why? When you pay in your own currency, the store’s/restaurant’s bank abroad will apply the exchange rate and it is usually worse than the exchange rate your own credit card company applies. This could be because they (locally) have to buy your currency while your card provider would sell the same, and it could also be that it’s just a way to line their pockets a bit extra. I suggest you ask your bank before you travel which would be more advisable.

Please remember: currencies tend to fluctuate, and as we’re heading into more unstable economic times, things change daily. Keep an eye on exchange rates while you travel to avoid any unnecessary surprises. This is true for stable “safe harbor” currencies like the CHF or USD as well as currencies from countries which are considered less safe, e.g. SEK or GBP, usually for political reasons.

If you have questions, please don’t hesitate to contact us. We would be happy to try and answer your specific questions.